WRITTEN BY: CAROLYN IRELAND

TORONTO

Published April 20, 2022

The deceleration in the Toronto-area real estate market continues as buyers and sellers come to grips with the most recent interest rate hike by the Bank of Canada.

“I’m hearing a lot of ‘wait-and-see,’ ” says real estate agent Manu Singh of Right at Home Realty Inc. “They’re feeling a bit paralyzed.”

Amidst the confusion, some properties are seeing sluggish activity while some outliers are creating a frenzy.

“Every week it feels like it’s different with the market.”

Mr. Singh is working with clients who entered the contest for a four-bedroom detached house in the Baby Point neighbourhood in Toronto’s west end.

The house was listed with a below-market asking price around the $2.8-million mark and Mr. Singh estimated it would sell for $3.2-million or possibly $3.3-milllion.

“We were expecting six to eight offers,” he says.

He was shocked when 16 bidders entered the fray and the house sold for $3.975-million.

The house has been renovated within the past two or three years, he says, and it sits on a deep lot in a coveted school district. Supply of that type of house is still very limited, he says.

“They don’t know when the next one is going to come up.”

Buyers know they are paying peak prices in the current market, he says. Many are bypassing houses with a reno that’s more than five years old.

Not far away in the Sunnylea area, a raised three-bedroom bungalow was listed with an asking price of $2.89-million and sold for $4-million.

“My clients are flustered,” he says, after losing out to two bidders who each paid more than $1-million above asking.

Mr. Singh says that segment of the market is not held back by an increase in interest rates. For affluent move-up buyers, the challenge is the lack of supply.

Buyer fever abates west of Toronto amid signs of softening home prices

The Bank of Canada raised its key rate by half a percentage point in April to 1 per cent. That’s the largest move at one sitting since 2000.

First-time buyers are more sensitive to rising rates, he says, and many who were looking for semi-detached houses in the 416 area code while rates were at their lowest have now switched their search to a two- or three-bedroom condo.

Condos had fallen out of favour for a time but he’s seeing a return to high-rise living now that pandemic restrictions have been loosened and some workers are returning to the office.

n early April, Mr. Singh listed a two-bedroom, two-bathroom unit at 628 Fleet St. with an asking price of $979,000. Unit 3007 had good views of the lake and the city.

Over the course of one week, the condo had 14 showings. The unit sold for $1.186-million when three competing buyers showed up on offer night.

“We had expected at least five or six,” he says. “I’m seeing ebbs and flows in the condo market, too.”

According to the Toronto Regional Real Estate Board, the condo slice of the market was more robust in March than the segment for single-family homes.

In the core 416, sales of condo units dropped 18.3 per cent in March from the same month last year. In the outer 905, condo sales fell 16.3 per cent in March from March, 2021.

Toronto real estate listings swell, taking the edge off buyers

In March, the average price for a condo stayed essentially flat at $831,351 compared with February, while in the suburbs, the average price also evened out at $760,410.

That compares with a steeper drop in sales of about 34 per cent for single-family homes in the GTA in March compared with March of last year.

Elli Davis, real estate agent with Sotheby’s International Realty Canada, says her inventory of houses and condo units is low.

“We sort of went into a little bit of a quiet time,” she says. “It’s not as hysterical and fast.”

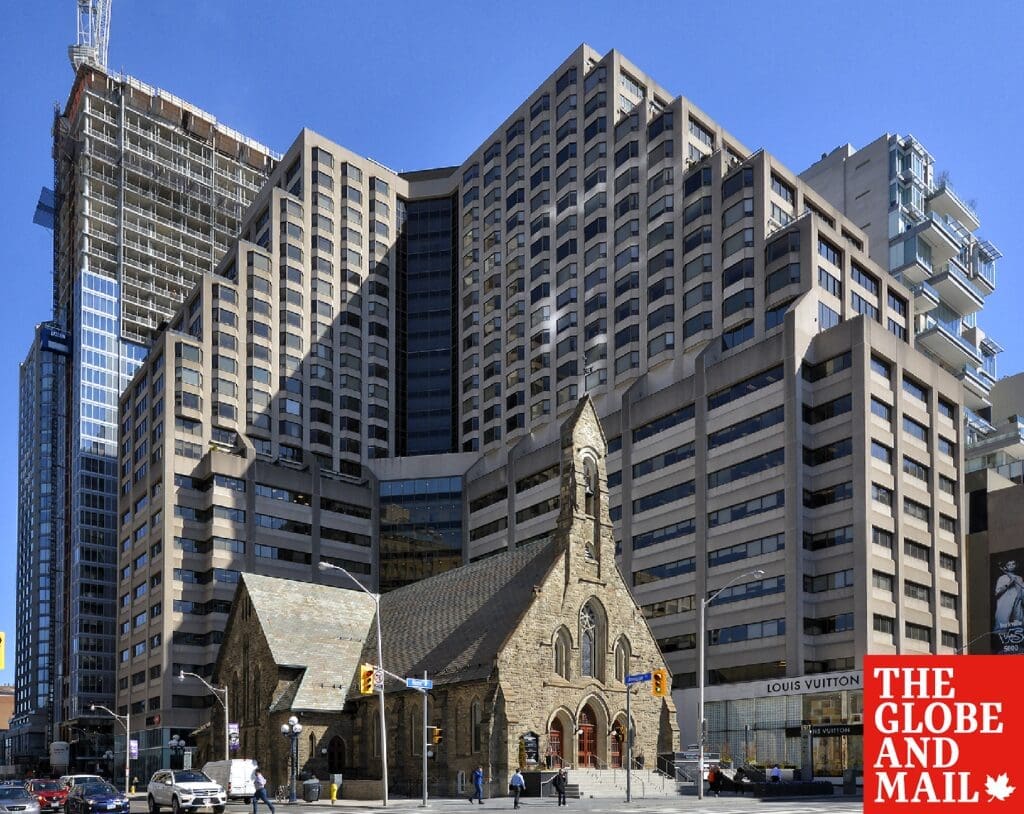

Ms. Davis is listing a two-bedroom, two-bathroom unit in the Renaissance Plaza, 175 Cumberland St., Suite 2202, at Avenue Road and Bloor Street. The tower, built in the mid-1980s, has only one other unit currently for sale, she says.

Ms. Davis plans to list the unit, which needs a rejuvenation, with an asking price of $1.795-million.

Ms. Davis says some condo units are selling within a day or two of listing – especially if there’s no other inventory in the building. Others are not moving.

Investors who buy older condos and renovate them for resale can command a premium, but some of those are languishing longer than in the past, she says.

“I think there’s going to be a drop in their expectations.”

Ms. Davis expects the rising interest rate environment to further calm the market.

Paul Ashworth, chief North America economist at Capital Markets, says Canada’s overreliance on housing and household debt together make it the country most susceptible to the impact of higher interest rates.

Bank of Canada Governor Tiff Macklem embraced a new-found hawkishness, he notes, and Mr. Ashworth is predicting another hike of half a percentage point in June.

Household debt hit 170 per cent of disposable income in Canada at the end of 2021, up from 164 per cent immediately before the pandemic and 135 per cent at the time of the 2008 financial crisis.

On a comparable basis, U.S. household debt is currently only 139 per cent of disposable income, unchanged from the prepandemic level and down markedly from the peak of 172 per cent in 2009.

Canada has finally matched the household leverage that preceded the housing collapse in the United States, he notes.

“Canada’s economy is also much more dependent on residential investment than any other advanced country and, at this stage, it isn’t even close,” he says in a note to clients.

The conundrum the central bank faces is that residential investment is the most rate-sensitive part of any economy, the economist says.

With signs that housing is already slowing in response to the rise in mortgage rates over the past few months, Mr. Ashworth doubts that the central bank will be able to raise interest rates much beyond 2 per cent.

“If we’re wrong and it rushes to do so, the resulting downturn in housing will be much worse.”